US-China Trade War

US-China trade war — Who is the potential beneficiary?

2019/10/1, Beijing, China

According to the latest IMF research report, countries such as Europe, Mexico and Vietnam are potential beneficiaries. IFF analysts also pointed out that the global economy faces potential downside risks.

US-China trade tensions have negatively affected consumers as well as many producers in both countries. The tariffs have reduced trade between the US and China, but the bilateral trade deficit remains broadly unchanged. While the impact on global growth is relatively modest at this time, the latest escalation could significantly dent business and financial market sentiment, disrupt global supply chains, and jeopardize the projected recovery in global growth in 2019.

The imminent US tariffs on Chinese goods are expected to throw up some unexpected winners in Europe, a study shows. The gains for the European countries are only likely to increase if China chooses to retaliate.

Move over Vietnam and Taiwan. The latest round of US tariffs on Chinese goods set to kick in on September 1 would also benefit the European economies, albeit moderately, a new report showed. The gains would only multiply, if China retaliates with further tariffs on US imports, according to economists from the Munich-based ifo Institute.

US President Donald Trump announced a 15% tariff on another $300 billion (€268 billion) worth of Chinese goods earlier this month, escalating an ongoing trade dispute between Washington and Beijing that has seen the two sides slap punitive tariffs on each other's goods. China has threatened to retaliate to the latest round of tariffs even as it negotiates a trade deal with the US.

The trade dispute between the world's largest economies has weighed on global growth, even stoking fears of a recession. But a handful of economies in Asia such as Vietnam and Taiwan have so far benefited from the spat as more and more firms shift production out of China and US importers look for alternatives to Chinese goods.

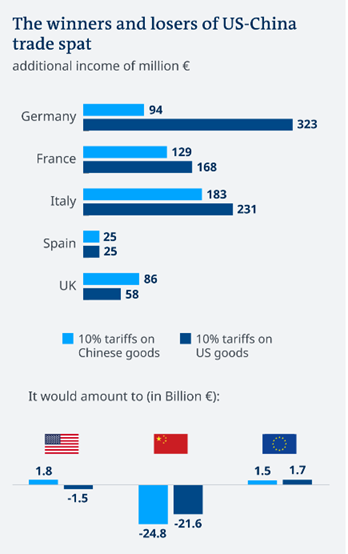

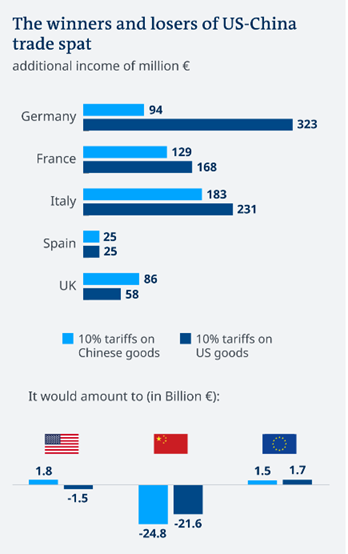

The European Union is expected to see an additional income of €1.5 billion, if the US goes ahead with the 10% tariffs. Italy with €183 million would be the biggest beneficiary followed by France (€129 million) and Germany (€94 million).

If China retaliates with a further 10% tariff on US goods, the EU would see additional revenue of €1.7 billion. Germany would be the biggest gainer with €323 million in additional income. Italy (€231 million) and France (€168 million) would also significantly benefit from the Chinese retaliation.

Germany's export-driven economy is expected to be the biggest winner if China retaliates as Chinese importers would turn to Germany — a major producer of intermediate goods such as car parts — to source intermediate goods to avoid higher tariffs.

The effect on producers is more mixed, with some winners and many losers. Some US and Chinese producers of goods competing in domestic markets with imports affected by tariffs, as well as competing third country exporters, are potential winners. However, US and Chinese producers of the goods affected by the tariffs as well as producers that use those goods as intermediate inputs, are potential losers.

Trade diversion is one channel through which producers are affected. Aggregated bilateral US data does suggest that trade diversion has occurred, as the decline in imports from China appears to have been offset by an increase in imports from other countries.

For example, US imports from Mexico increased significantly among some goods on which the US imposed tariffs. After the $16 billion list was implemented in August, a sharp decline of nearly $850 million in imports from China was almost offset by about $850 million increase from Mexico, leaving overall US imports broadly unchanged. For other countries such as Japan, Korea and Canada, one can observe smaller increases in US imports relative to the levels in September-November 2017. Of course, aggregate data could be masking other factors driving the bilateral trade patterns, such as the use of inventories. For example, there was little or no change in imports from third countries in the case of photosensitive semiconductor devices.

The other channel by which producers could be affected is through market segmentation in the price of traded goods. This was most clearly observed in the case of soybeans, where US exports to China fell dramatically in 2018 after China imposed tariffs. The United States was China’s dominant soybean supplier, along with Brazil, in 2017. With the tariffs, the price of US soybeans fell while that of Brazilian soybeans increased, as US exports to China dropped to near zero and Brazilian exports to China trended higher. Though prices have since re-converged and soybean exports to China have resumed to some extent, US soybean farmers suffered, while those in Brazil benefited from trade diversion and market segmentation.

At the global level, the additional impact of the recently announced and envisaged new US-China tariffs, expected to extend to all trade between those countries, will subtract about 0.3 percent of global GDP in the short term, with half stemming from business and market confidence effects. The IMF’s forthcoming G-20 Surveillance Note in early June will provide further details. These effects, while relatively modest at this time, come on top of tariffs already implemented in 2018.

Moreover, failure to resolve trade differences and further escalation in other areas, such as the auto industry, which would cover several countries, could further dent business and financial market sentiment, negatively impact emerging market bond spreads and currencies, and slow investment and trade.

In addition, higher trade barriers would disrupt global supply chains and slow the spread of new technologies, ultimately lowering global productivity and welfare. More import restrictions would also make tradable consumer goods less affordable, harming low-income households disproportionately. This type of scenario is among the reasons why we referred to 2019 as a delicate year for the global economy.

Order the report and sample

sales@assointernationalconsulting.com

contact@assointernationalconsulting.com

ASSO regards each project as the best communication bridge between us and our customers. ASSO solemnly promises that ASSO will treat each project as our most important customer project. We will go all out and never give up. ASSO regards each other's excellence as the purpose of our service. ASSO's services involve regional analysis, market data, player share, market decision-making, marketing and product positioning

– Allen King

Leave a comment

All fields marked with an asterisk (*) are required